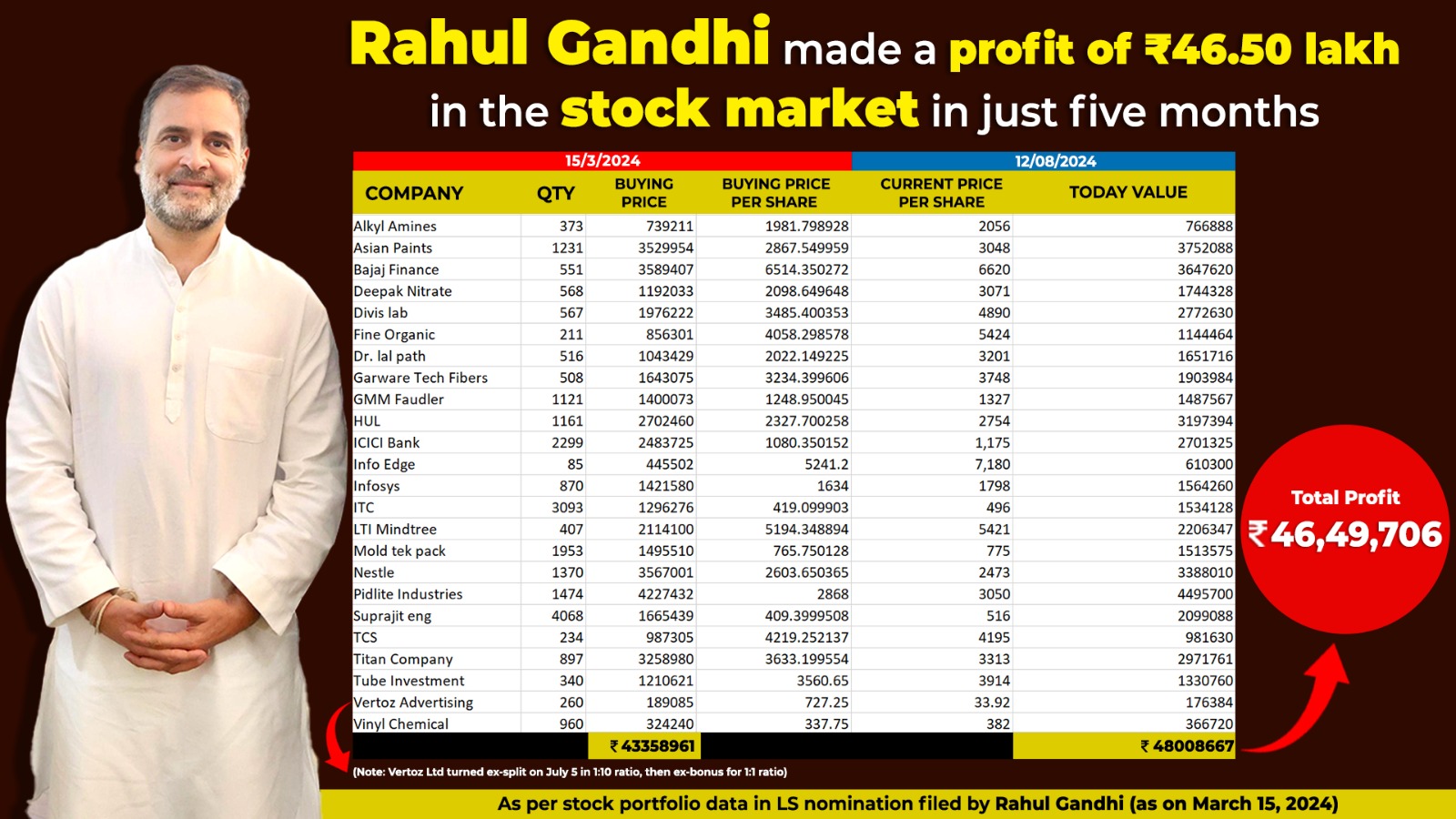

As Rahul Gandhi continues to raise suspicions about the stupendous growth of the Indian stock markets in the Modi 3.0 era, data has revealed that the Leader of Opposition (LoP) made a profit of Rs 46.49 lakh from his stock investments in the last five months.

IANS did the math and found that the value of Rahul Gandhi’s portfolio in the stock market increased from about Rs 4.33 crore (as on March 15, 2024), to nearly Rs 4.80 crore (as on August 12, 2024).

The profit has been calculated on the basis of shares revealed in the Lok Sabha nomination filed by Rahul Gandhi for the Rae Bareli constituency.

Rahul Gandhi’s portfolio includes stocks like Asian Paints, Bajaj Finance, Deepak Nitrite, Divis Labs, GMM Pfaudler, Hindustan Unilever, Infosys, ITC, TCS, Titan, Tube Investments of India and LTIMindtree, among others.

His portfolio includes about 24 stocks, out of which he is currently incurring losses in only four companies – LTI Mindtree, Titan, TCS and Nestle India.

Apart from these, stocks of several small companies like Vertoz Advertising Ltd and Vinyl Chemicals are also included in the Congress leader’s portfolio.

Due to corporate action seen in Vertoz Advertising Ltd, the number of shares in this company increased to 5,200, which was 260 as on March 15, 2024, the number crunching revealed.

The stock market is witnessing a massive boom in the third term of the Prime Minister Narendra Modi-led NDA government. Sensex and Nifty have broken many records in the last few months, reaching new highs.

Meanwhile, in a video message on Sunday, Rahul Gandhi demanded that the Prime Minister announce a JPC probe into the charges against the SEBI chief levelled by US short-seller Hindenburg. He claimed that the integrity of the “securities regulator entrusted with safeguarding the wealth of small retail investors, has been gravely compromised by the allegations against its Chairperson”.

However, the investors brushed off the latest Hindenburg allegations as the benchmark indices ended largely flat on Monday.

Sushil Kedia, Founder and CEO, Kedianomics, said that the short-selling firm Hindenburg was exposed 18 months ago when they made big claims about the Adani Group and the Supreme Court-monitored investigation found nothing. SEBI also issued a show-cause notice to the research firm for violating securities market rules.

“Now 18 months later, Hindenburg suddenly comes and claims on social media that they have something big about India. The aim was to destroy the Indian stock market by breaking the trust of retail investors,” Kedia told IANS.

Since the beginning of this year, Sensex has given returns of about 11 per cent and Nifty about 12 per cent.